Meet the Biggest Impact Investors in Web3

A $3 trillion market (and growing)

Hello Impact Nation,

Many of you reached out asking the same question about our latest post.

It was a short article about the evolution from Web1 to Web3, but it started an impressive flow of questions.

Or - to be precise - a flow of the same two questions (summarized):

Investors: “I’m interested in Web3. How can I find more information and opportunities?”

Founders: “I am doing/aiming to do a startup in Web3. How can I find investors?”

Basically, “Who’s impact investing in Web3 right now?”

We heard you!

And we have prepared an easy-to-use list in this newsletter.

You will not find our name (although we are involved in this area). First, we want to avoid any conflicts of interest. Second, we want to start with a list of VCs and what they are doing.

Enjoy!

This Week We Are Diving Into:

1. Meet the Biggest Impact Investors in Web3

2. Good Gossip

3. News & Opportunities

4. Coming Soon: Interview with David Orban

Elisa

The Impact Lady

Who Are the Biggest Impact Investors in Web3?

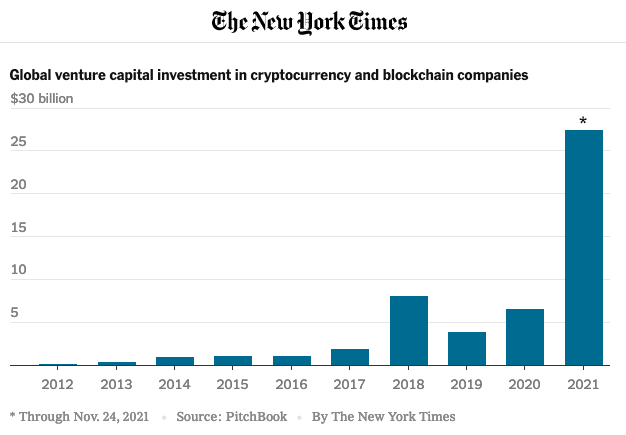

VCs invested about $30 billion globally in 2021, more than the previous ten years combined.

Blockchain startups are among the top of the food chain (pun intended).

We are talking about an average investment in Blockchain startups of $20 million *per day*.

For 365 days, in 2021, VCs have invested about $20 million daily in blockchain/Web3 companies (source: Pitchbook).

Moreover, the average seed round has increased from ‘just’ $1.5M in 2020 to $3.3M in 2021. That’s a +120% growth in one year.

There is an important appetite in Web3 in general. Impact investing plays an important role in it.

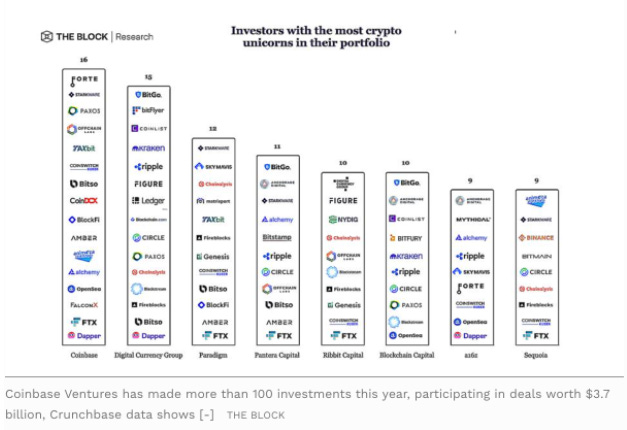

These VCs have not just invested in Web3. They have collected an impressive number of unicorns (startup companies that have reached a value of over $1 billion).

Coinbase Ventures leads the list with 186 investments since its launch in 2018.

The founder of Coinbase Ventures - Coinbase - is a unicorn itself.

$20 million invested in Coinbase by Andreessen Horowitz in 2013 has been valued at about $11 billion in 2021 (The New York Times.)

The same Andreessen Horowitz announced a $2.2 billion crypto fund in June 2021. The biggest VC fund in crypto … for about a month. Until the venture capital firm Paradigm – run by a Coinbase co-founder – announced a $2.5 billion crypto fund (The New York Times).

Even larger and well-established funds like Tiger and Sequoia are now aggressively entering the market through late-stage equity investments.

The short-list of investors with most crypto unicorns in their portfolio

The list is based on our knowledge of the industry, major media (eg. The New York Times), and databases (eg. Crunchbase, Pitchbook, etc.).

This list doesn’t seek to be exhaustive; it aims to help you and your venture, whether you are a startup founder or an investor.

In alphabetical order:

A16z / Andreessen Horowitz

Location: Menlo Park, California, United States

Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

In their portfolio: Dapper, OpenSea, Ripple

Blockchain Capital

Location: San Francisco, California, United States

Investment Stages: Seed, Series A, Series B

In their portfolio: Abra, Securitize, Anchorage

Coinbase Ventures

Location: San Francisco, California, United States

Investment Stages: Pre-Seed, Seed, Series A, Series B

In their portfolio: Compound, BlockFi, Dharma

Digital Currency Group

Location: New York City, New York, United States

Investment Stages: Seed, Series A, Series B

In their portfolio: Trust Machines, Livepeer, Elliptic

Pantera Capital

Location: Menlo Park, California

Investment Stages: Seed, Series A, Pre-Seed, Early Stage, Series B, Series C, Growth

In their portfolio: Ancient8, Stader Labs, Offchain Labs

Paradigm

Location: San Francisco, California, United States

Investment Stages: Pre-Seed, Seed, Series A, Series B, Series C, Growth

In their portfolio: Chainalysis, Matrixport, Fireblocks

Ribbit Capital

Location: Palo Alto, California, United States

Investment Stages: Seed, Series A, Series B, Series C, Growth

In their portfolio: Genesis Digital Assets, Kavak, Chipper Cash

Sequoia Capital

Location: Menlo Park, California, United States

Investment Stages: Seed, Series A, Series B, Growth

In their portfolio: Polygon, Binance, Bitmain

Tiger Global

Location: New York, New York, United States

Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

In their portfolio: PDAX (Philippine Digital Asset Exchange), Devron, Novi Connect

Are these Web3 companies ESG-complaint or impact-relevant?

As in every industry, some projects are ESG friendly, others are not. It’s for you to decide.

However, more than in other industries, technologies grouped under the umbrella name of Web3 have the potential to solve all the ESG’s challenges – starting from boosting financial equality.

Right now, Web3 is building the infrastructure that will shape the future.

As impact investors and impact founders, it’s our responsibility to support the projects with true potential to make the world a better place.

The game is on!

It should not be necessary to add any disclaimer but … Let’s say it anyway! This is not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. DYOR - Do Your Own Research!

Good Gossip

Congrats to …

Lance Uggla ↪ has been appointed CEO of Climate Investment Platform BeyondNetZero, the climate growth equity venture part of General Atlantic.

Martijn Hoogerwerf ↪ has been appointed head of Sustainable Finance for Asia Pacific at ING bank.

Wendy Holley ↪ has been appointed as the first Chief Sustainability Officer at JTC, a provider of fund management services listed on the London Stock Exchange.

Cara Chacon ↪ has been appointed as the first Senior Vice-President of ESG at Saks, the luxury retailer.

Union54 ↪ raised $12M to allow African software companies to issue and manage debit cards without a bank. Lead investor: Tiger Global. Other investors: Vibe VC, Earl Grey Capital, and Packy Mccormick’s Not Boring Capital.

Clipboard Health ↪ raised $80M in funding within consecutive series B and C rounds to match nurses with open shifts at nearby healthcare. Lead investors: Sequoia Capital and IVP. Other investors: Y Combinator, Caffeinated Capital, Initialized Capital, and SciFi VC.

Cerve ↪ raised $2M in seed round funding to digitize food distribution post-COVID. Lead Investor: Orkla Ventures. Other investors: MP Pensjon and nFront Ventures.

Welcome Tech ↪ raised $30M in funding to build an app helping immigrant families in the U.S. Lead investor: TTV Capital. Other investors: Owl Ventures, SoftBank’s Opportunity Fund, Mubadala Capital, and Next Play Capital.

Beam Impact ↪ raised $13.3M in series A funding to turn everyday purchases into a way to support social causes. Investors: Ulu Ventures, HearstLab, and several strategic angels including Brian Long, Andrew Jones, and Ruchika Julapalli.

News & Opportunities

BlackRock must hit ESG targets or pay more to borrow money. $4.4 billion credit facility is tied to sustainability goals.

Shell’s directors risk shareholder litigation for alleged failing climate strategy. Shareholder ClientEarth accuses Shell of failing to adopt and implement a climate strategy that aligns with the goals of the Paris Agreement.

White Oak adopts Global Impact’s impact analytics system. The market for impact Saas companies is growing at impressive rates.

IBM announces IBM Impact, a new framework for the company’s ESG governance.

NCR, a $5.52 billion market cap software company (NYSE: NCR), has committed to net-zero greenhouse gas emissions by 2050. The path to zero emissions includes transitioning the NCR fleet to electric vehicles.

Food giant ADM issues sustainable bonds. With annual revenues of over $85 billion and a presence in 200 countries, ADM has a massive direct impact on the environment.

🚀 COMING SOON

From Web3 to Meta, The Future of Impact Investing - With David Orban, Managing Advisor Beyond Enterprizes

Video interview available from Thursday - Stay tuned

Video interview available from Thursday - Stay tuned

Great article and summary of who are the big players in the space. As an architect and designer I have been very exited to enter this space and I am working on a few projects in the metaverse where I am looking for partners to join in, especially as I am an ambassador of sustainability for many global

Organisation, also using recycled

Plastic waste 3 d printed among others. I am interested in how architecture and Web 3.0 can merge in a meaningful way solving the problems of our planet.