Megatrends In 2022 And Beyond: Sustainability And New Technologies

Plus the latest news on fundraising and people in impact.

Hello Impact Nation,

Have you ever heard about a Megatrend?

It would be easier if a Megatrend were just a name of a Sci-Fi robot from the future.

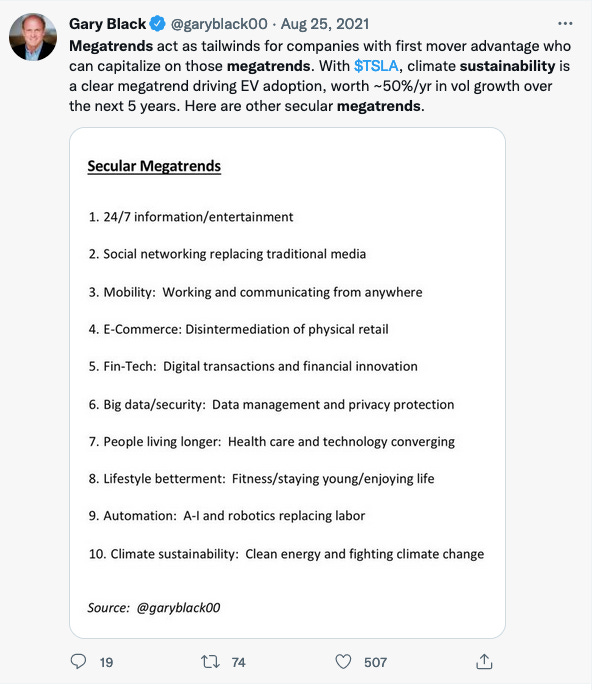

The reality is that megatrends are macroeconomic forces that are shaping our world and our future – with huge implications for our society.

Whether for some people megatrends highlights challenges and risks, I like to think about them as opportunities. It means we can work together in advance to deescalate threats by investing, promoting and leading projects and businesses that are both sustainable and accelerated by new technologies.

Tesla is just one example where new technologies are accelerating sustainability to solve the challenges of megatrends like clean energy by completely revolutionizing an industry.

Let’s dive deep into these two Megatrends for 2022 and beyond.

Enjoy!

Elisa, the Impact Lady

This Week We Are Diving Into:

1. Megatrends In 2022 And Beyond: Sustainability And New Technologies

2. Good Gossip

3. News & Opportunities

Megatrends In 2022 And Beyond: Sustainability And New Technologies - with Elisa Giudici, Co-founder of Impact Investing In Tech

Enjoy the audio or watch the video. You are in charge!

📺 VIDEO VERSION

📣 AUDIO VERSION

🤝 MEET THE SPEAKER ️

Elisa Giudici, Co-founder of Impact Investing In Tech

Good Gossip

Congrats to …

Jan Ernst de Groot ↪ has been appointed Chief Sustainability Officer at Ahold Delhaize, the Dutch parent of U.S. brands such as Food Lion and The Giant Company.

David Thomas ↪ has been appointed Senior Portfolio Manager at Robeco, a pure-play international asset manager founded in 1929.

Jayne Mammatt and Jyoti Vallabh ↪ have been appointed Sustainability and Climate Change specialists at Deloitte Africa, a Global professional services firm.

Jeanne Ng ↪ has been appointed Chief Sustainability Officer at BlueOnion, a subsidiary of WealthAsia

Proof of Impact ↪ raised $6M in Series A funding to accelerate go-to-market efforts focused on private credit and private equity fund managers. Lead investor: Rakuten Capital. Other investors: Franklin Templeton Blockchain Fund, Five T, Blockrocket VC, Advaita Capital, Franklin Templeton Advisors, CV VC, Working Capital Fund, Asiri and Oxford Angel Fund

Terabase Energy ↪ raised $44M in Series B funding to digitalize and automate the deployment of utility-scale solar power plants. Lead investors: Breakthrough Energy Ventures, Prelude Ventures, and SJF Ventures

Longroad Energy Holdings ↪ raised $500M to help drive a major expansion in its wind, solar and storage portfolio. Lead investor: MEAG. Other investors: NZ Super Fund and Infratil

VoltStorage ↪ raised £24M in Series C financing to develop larger-scale redox flow storage systems for commercial and agricultural enterprises. Lead investor: Cummins Inc.

Aurora Hydrogen ↪ raised $10M in Series A funding to develop emission-free, low-cost hydrogen technology. Lead investor: Energy Innovation Capital. Other investors: Williams, Shell Ventures, Chevron Technology Ventures and the George Kaiser Family Foundation

Buoyant Ventures ↪ raised $50M to cash in on emissions mitigation.

News & Opportunities

The Monetary Authority of Singapore (MAS) to Launch Inaugural Green Bond

BP to Invest up to $60 Million in new EV Battery Research & Development Centre

Sprite ditches its iconic green bottle to boost green packaging

BASF to Surpass 25% Renewable Energy in North America

Lear Corporation Commits to 100% Renewable Energy

Biden announced the launch of the Climate Smart Buildings Initiative

It should not be necessary to add any disclaimer but … Let’s say it anyway! This is not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. DYOR - Do Your Own Research!