The Next ESG Trend: Buying Weapons

Are you ready to impact invest in weapons? This may be the next ESG

Hello Impact Nation,

We promised to talk about the Good, the Bad, and the Cute Ugly of impact investing.

It’s time to go Ugly!

And there is nothing cute about it.

In fact, our industry is trying to go ugliER than anybody expected.

Following the war in Ukraine, Citi’s analysts are proposing ESG funds to invest in defense companies (a.k.a. weapons producers).

Defense companies are (... at least according to Citi) key to “maintaining peace, stability, and other social goods”.

Citi is not alone. There is a growing trend that considers war not only necessary but “good”.

In the next paragraphs, we’ll go deeper into this rabbit hole.

Let your voice be heard too. Leave a comment on this post, or hit the reply button to this email.

This Week We Are Diving Into:

1. The Next ESG Trend: Buying Weapons

2. Good Gossip

3. News & Opportunities

4. Meet the Speaker: David Orban

Let’s do it!

Elisa

The Impact Lady

The Next ESG Trend: Buying Weapons

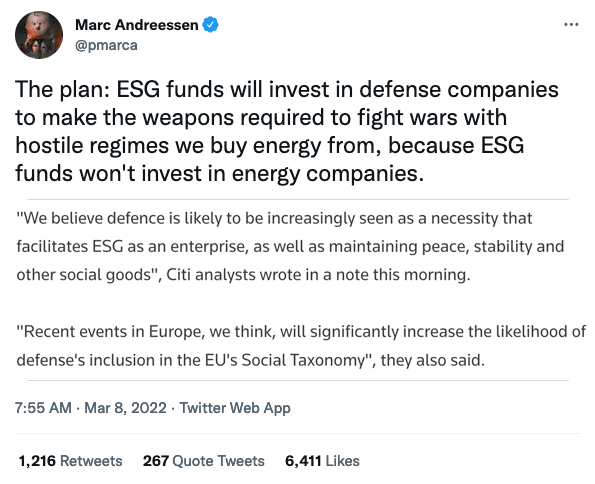

This tweet is Marc Andreessen’s reaction to our topic.

Marc is the founder and managing partner of one of the most famous venture capital worldwide A16Z.

He’s talking about the (in)famous quote of Charles J. Armitage and Samuel Burgess, analysts at City Bank.

From their point of view: “Defending the values of liberal democracies and creating a deterrent, which preserves peace and global stability, is so important that weapons makers should be included in funds that carry an E.S.G., or environmental, social and governance”.

Citi is not alone.

On the other side, Marc’s condemnation is in good company too:

The possibility of buying weapons and investing in military technology under the ESG flags is still open to discussion in some powerful rooms.

The suggestion seems to label military contractors as ESG compliant in the “taxonomy regulation” of the European Union (the standard in guiding private and public investors).

In order to do that, the idea is to point out that these kinds of investments “have been scrutinized and approved by a democratically elected government.”

Many investors (and their money) in the USA and Europe moved to ESG funds and pulled out off the military industry.

On the other side, military contractors and their stocks had a steep rise since the Russia-Ukraine conflict started.

Can they just change a label and make the world accept weapons as ESG?

What would you do if you were an investor in one of these funds? Would you pull out or would you enjoy a (possible) tone of money thanks to deadly weapons and technology?

We want to hear your voice. Click here to leave your comment (or reply to this email) and share your thoughts.

It should not be necessary to add any disclaimer but … let’s say it anyway! This is not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. DYOR - Do Your Own Research!

Good Gossip

Congrats to …

Donna Rourke ↪ has been appointed ESG Director at BNP Paribas Real Estate UK (Banque Nationale de Paris)

Elena Daniel ↪ has been appointed Senior Vice President, Head of Environmental, Social and Governance (ESG) at Logistics Property Co., a logistics real estate platform.

Dustyn Lanz ↪ has been appointed Senior Advisor at ESG Global Advisors, a consultancy firm.

Richard Manley and Carine Smith Ihenacho ↪ have been respectively appointed chair and vice-chair at SASB Investor Advisory Group (IAG), a membership of 60 global asset owners representing $52T AUM.

Aurora Solar ↪ raised $200m at $4b valuation to develop software for the solar industry. Co-lead investors: Coatue Management and Energize Ventures. Other investors included Fifth Wall and Iconiq, Lux Capital and Emerson Collective.

ESGgo ↪ raised $7m in Seed fund, to enable next-generation ESG data collection, reporting, and analysis. Lead investor: Glilot Capital.

Our Next Energy ↪ raised $65M in series A round, to develop energy storage solution. Lead investor: BMW i Ventures and Coatue Management, Other investors included Breakthrough Energy Ventures, Assembly Ventures, Flex, and Volta Energy Technologies.

Provenance ↪ raised $5M to develop software that tackles greenwashing and empowers citizens to choose products that match their values. Lead investor: Working Capital Innovation Fund and Nordic Eye. Other investors included: The Brandtech Group, Digital Currency Group, and angel investors Nicolas Cary (Blockchain.com), Jon Reynolds (SwiftKey), Peter Gabriel (musician and activist).

Volocopter ↪ raised $170M in Series E round, to empower city sustainability by operating small aircraft as taxi-style fleets in the urban areas. Lead investor: Wp Investment, Other investors included Honeywell, Atlantia, Whysol.

News & Opportunities

Eni and Livestream aim to invest £175 million ($230 million) in green energy SPAC listed in London.

Iberdrola issues €1 billion green bond issue. The company has reopened the fixed income market in Europe in the midst of the crisis generated by the war in Ukraine.

More than half of UK pension funds have made impact investments with total assets under management of around £150 billion.

Amazon launches a digital health accelerator with a focus on virtual reality. Partnering with Children's Hospital Los Angeles, the AWS Healthcare Accelerator will be open to healthcare startups targeting any patient population, not just children. Application for the first batch is closed, however, it’s expected that more will follow here*

RHL Ventures is scouting for investment opportunities in ESG, especially in the healthcare and financial sectors. RHL Ventures is a Malaysia VC firm in the midst of finalizing a new vehicle, the Hibiscus Fund.

🎙 PEOPLE IN IMPACT

Meet: David Orban

David is an early adopter of blockchain technologies and an investor since 2010. He was among the first Ethereum owners at its launch in 2014.

He is a member of the faculty and advisor to the Singularity University, based at the NASA Research Park in California, an investor in the Singularity University Labs Accelerator Fund (now SUVentures), and was President of Singularity University Italy.

Today David serves as Managing Advisor of Beyond Enterprizes, a strategic advisory firm for blockchain and new technology with a $14 billion capitalization of its 50 clients (Updated 2021).

He invests in startups directly or through his Network Society Ventures, a seed-stage global investment firm focused on innovative startups at the intersection of exponential technologies and decentralized networks.

As a sought-after speaker, he has given over 100 keynote addresses and speeches around the world for organizations including Abbvie, Cisco, Oracle, Roche, E&Y, Accenture, Gilead, ENEL, Intesa, Banca Sella, Mediolanum, Alphabet, Internet Advertising Bureau, European Foundation for Management Development, and H-Farm.

Trivia: What’s Singularity University? Based at the NASA Research Park in Moffett Field, California, the Singularity University is a collective of innovators dedicated to helping prepare the globe’s top leaders and organizations for the challenges facing the world today—and tomorrow—by teaching them to think exponentially, embrace emerging technologies, and forge new connections across a global ecosystem.

David will be a speaker at Expanse, the Global Summit for Impact Investing in Tech. Join him today!

🚀 COMING SOON

How to Build Viable Business Models in Impact - With Roshni Durve, Director & Senior Advisor at SMEFunds Capital

Video interview available from Thursday - Stay tuned

🔥 If you liked this post, why not share it?