The Toolbox for Impact Investing in Metaverse

And why the largest concert in history matters!

Hello Impact Nation,

Do you know which is the largest concert in history?

If you answered Woodstock (1969), you are … wrong!

Its attendance was “only” 400,000.

(And – yes – this topic is connected with impact investing. Keep reading to find out why!)

Before the Covid, the largest concert in history was Rod Stewart at Copacabana (1995), with 3.54 million participants. (Although, our French friends strongly challenge this “Anglo-Saxon Conspiracy.” Their winner is, of course, a French artist: Jean-Michel Jarre at Moscow 1997.)

But why are we talking about concerts?

Our last newsletter was all about impact investing and Metaverse.

A metaverse is a network of 3D virtual worlds focused on social connection.

– Wikipedia

We received an unprecedented number of questions. Mainly “How can invest in good projects in the Metaverse (and recognize the bad ones)?”

You asked. We heard!

In this week’s issue, we’ll share a toolbox for impact investing in the Metaverse.

And concerts are part of it.

Enjoy!

It should not be necessary to add any disclaimer but … Let’s say it anyway! This is not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. DYOR - Do Your Own Research!

This Week We Are Diving Into:

1. The Toolbox for Impact Investing in the Metaverse

2. Good Gossip

3. News & Opportunities

4. Coming Soon: Interview with Maria Phillips

Elisa

The Impact Lady

The Toolbox for Impact Investing in Metaverse

In April 2020, Epic Games organized a live concert inside the virtual game Fortnite.

27.7 million players attended from any corner of the world.

Twenty-seven million people - live!

That’s almost 8X the attendance of the (previous) largest concert in history: Rod Stewart at Copacabana (1995), with “only” 3.54 million participants.

Now, we know what you are thinking.

“How can you compare the two events?”

Epic Games didn’t have to rent the land. They didn’t need to get the local authorizations, fly the band to Copacabana, or organize the local staff.

… exactly!

Epic Games reached 8X the attendance without any of the hassles.

That’s the beauty of the Metaverse.

That’s why Microsoft, Facebook, and many other large corporations have been trying to build their metaverse for a while (and why many startups are building decentralized projects on the same topic).

How far did they go?

How to keep track of Metaverse.

Metaverse is an industry in continuous evolution.

To get the best investments, and make a good impact, you should ask its unique set of questions.

What areas are the backbones of Metaverse?

What should you track?

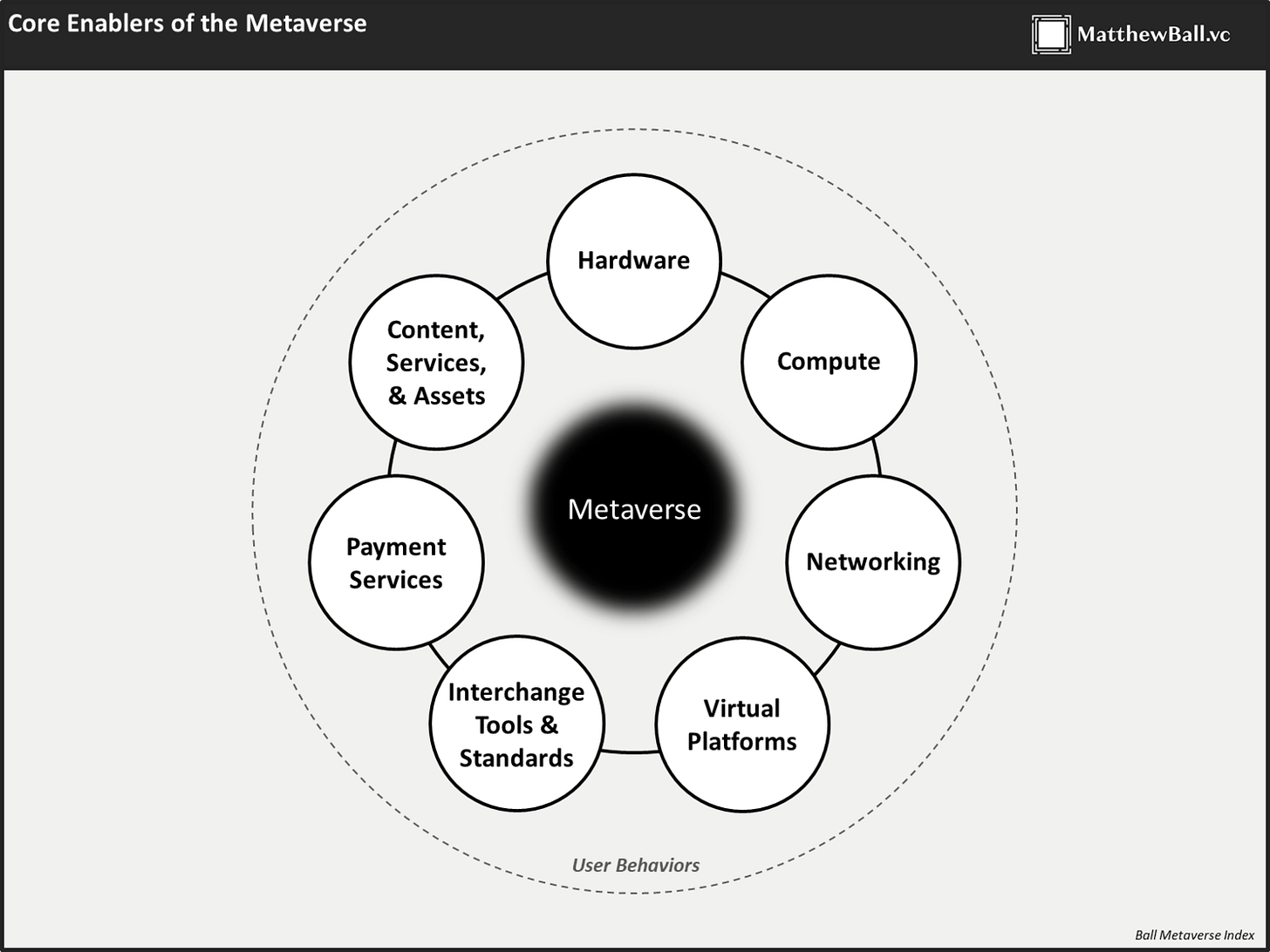

To answer, we’ll borrow the excellent framework designed by Matthew Ball, a venture capitalist and angel investor who has been analyzing the evolution of the Metaverse for many years.

Matthew lists eight core categories that are the keys to Metaverse:

Hardware: This category includes physical technologies and devices, for example, VR headsets and haptic gloves or enterprise hardware used to operate or create virtual or AR-based environments, such as industrial cameras, projection, tracking systems, and scanning sensors.

Networking: This is about the network infrastructure — for example, 5G, high bandwidth, and so on. To reach a mainstream use of Metaverse, this kind of infrastructure must be high speed and high quality. This is still a challenge, especially in some emerging markets.

Compute: Not only does the network need to be mainstream and accessible to support the growth of the Metaverse, but the supply of computing power is also crucial for the success of the Metaverse.

Virtual Platforms: The development and operation of immersive 3D worlds, where users and businesses can explore, create, socialize, and participate in a wide variety of experiences.

Interchange Tools and Standards: The tools, protocols, formats, services, and engines that serve as standards for interoperability. They enable the creation, operation, and ongoing improvements to the Metaverse. These standards support activities such as rendering, physics, and AI, as well as asset formats and their import/export from experience to experience, forward compatibility management and updating, tooling, and authoring activities, and information management.

Payments: The support of digital payment processes, platforms, and operations (including cryptocurrencies)

Metaverse Content, Services, and Assets: The design/creation, sale, resale, storage, secure protection, and financial management of digital assets (virtual goods and currencies, as connected to user data and identity.) This contains all business and services “built on top of” the Metaverse.

User Behaviors: Observable changes in consumer and business behaviours (spending and investment, time and attention, decision-making and capability, etc.) These behaviours almost always seem like ‘trends’ (or, more pejoratively, ‘fads’) when they initially appear, but later show enduring global social significance.

The 3+1 rules for Impact Investing in Metaverse

The same core categories used to track the Metaverse’s evolution, are keys to scouting the best investments.

1. Look for the projects that are building the backbone of the Metaverse. In the Internet Industry, Google built the backbone of search/information, Amazon the backbone of e-commerce, Apple and (originally) a few other companies such as Dell built the backbone of mainstream computer use. They were all great investments.

In Metaverse, we are even one step before that. Look for the Intel and AOL of the new era.

2. Check the final impact the project will have on real life. Is a project using the Metaverse just because is trendy? Or did they attract 27.7 million people to a concert like Epic Games?

Of course, the concert is just an example. Feel free to look for a more “serious” impact (but don’t underestimate the power of fun).

3. (Especially in impact investing) fund the projects that are aligned with your value. Impact investing is not just about money, but doing good. For example, you might be passionate about green tech and making an impact on the environment. Or you might prefer making an impact on education, or financial inclusion.

What is your preferred SDG (Sustainable Development Goal)?

3+1. Always do your own research on the team. In traditional tech investing, a great founding team is often more important than the original idea. In impact investing they are even more important. You will rarely do good if you help a bad person.

Let me close with a final rule.

3+1+1. Have fun. This rule is not just for the Metaverse. It’s always true.

Good Gossip

Congrats to …

Paul Jaffe ↪ has been appointed Real Assets ESG Head at Church Commissioners for England, the body which administers the property assets of the Church of England.

Jose De Mayne Hopkins ↪ has been appointed ESG Technical Director at MHA Macintyre Hudson, a firm of chartered accountants, tax, and business advisers.

Allan Wickham ↪ has been appointed Head of Occupier of the ESG consultancy team at CBRE, a global real estate advisor.

Jonathan Moon, Stephanie Sotiriou, and Christophe Borysiewicz ↪ have been respectively appointed Investment Director, Investment Manager, and Investment Director at Rathbone Greenbank Investments, an investment services provider in impact.

Aerones ↪ raised a $9M seed round to build robots for wind turbine inspection and maintenance. Lead Investor: Future Positive Capital and Change Ventures. Other investors: Skype founder Jaan Tallinn (through his vehicle Metaplanet), Vinted co-founder Mantas Mikuckas, Printify CEO James Berdigans, Capitalia, Pace Ventures, and EcoSummit.

Minka ↪ raised $24M to help move money more quickly across LatAm. Lead Investor: Tiger Global Management and Kasze.

Sun King ↪ raised $260M in a Series D round to widen clean energy access in Africa and Asia. Lead Investor: BeyondNetZero. Other investors: M&G Investments’ Catalyst and Arch Emerging Markets Partners.

News & Opportunities

U.S. banks are looking for senior bankers with ESG expertise in Hong Kong.

Accenture continues its series of ESG acquisitions by purchasing German sustainability consultancy Akzente.

Shell acquires Indian renewables firm Sprng Energy for $1.55 billion.

TPG launches a $7.3 billion climate fund.

Allianz publishes its commitment to net-zero emissions by 2030.

🚀 COMING SOON

The Raising Role of RegTech in Tech For Good - With Maria Phillips, Founder of Bridge RegTech

Video interview available from Thursday - Stay tuned