Growing an Impact Investment to $1.2 billion (After Almost Going Bankrupt)

How African unicorn Zipline proves the 3 rules behind a successful impact investment

Hello Impact Nation,

Today we are going to share very practical tips and actions $$$.

When family offices ask to pick our brains for impact investing, they often come with a disclaimer.

The words may be different, but the meaning is more or less always like this:

“I should talk with the investors, and decide how much funds can be diverted/relocated to impact investing”

At this point, we know that they will be surprised during our meeting.

There is no need to “divert” funds.

Impact investing is … investing. Pick a good project and you’ll make a profit.

On the other hand, if you can make profits, then you are expected to do so.

Profits are both the good and the dark side of impact investing.

This may be especially stressful for impact investing in tech.

They say that 9 on 10 tech startups fail.

Most impact startups will fail too.

But then, how to avoid bad projects?

Well, in the same identical way of every other industry:

– A bit of luck, a good network, and a lot of learning from successful case studies.

We are not in the business of providing luck – although they say that members of the Impact Nation tend to be lucky (pun intended) – but we can offer a network and great case studies.

Starting with Zipline, an African unicorn and a massive example of Tech4Good.

This Week We Are Diving Into:

1. From almost bankrupt to $1.2 billion evaluation. (Zipline and the three rules behind a successful impact investment.)

2. Good Gossip

3. News & Opportunities

4. Meet the Speaker: Olivia Sibony, CEO of SeedTribe

Let’s do it!

Elisa

The Impact Lady

From almost bankrupt to $1.2 billion evaluation. Zipline and the three rules behind a successful impact investment.

In February 2022, the world counts 1,000 unicorns, tech companies with a valuation of over $1 billion.

1,000 seems a large number for a rare beast – until you think that there are over 200 million companies worldwide, not counting many small businesses.

Are there any unicorns in impact investing?

Because impact investing is a new industry, and because it aims to do good, they often think that there are no unicorns in our industry.

Zipline, a startup operating in Africa, proves them wrong.

I met this company in 2019 – as an avid reader of Crunchbase – when they raised $190M in funding at a $1.2 billion valuation.

Zipline delivers life-saving medical supplies to African nations via drones.

Even more fascinating, the company started as an “app-store robot for kids”, a cute idea but hard to monetize.

They started in 2014, struggled, almost went bankrupt, struggled again, changed their business model (a ‘pivot’ in Silicon Valley jargon), struggled once more, and eventually grew to a $1.2 billion valuation.

(Not) an overnight success

The moment Zipline closed their series B funding, they became the ‘overnight success’ of the month for many media.

‘Up-all-night success’ sounds more appropriate to me.

There are few overnight successes but many up-all-night successes.

At the time of writing, Zipline raised a total of $491M in funding, and they have saved hundreds of thousands of lives.

Getting more without effort

This is not the place to details the history and struggle of Zipline.

And yet, if you want to know more about this company, just reply to this email and ask.

We’ll write a dedicated case study, or make an interview. We are always happy to share our passion.

3 rules for a successful impact investment

Let’s go deeper into the practical tips and actions.

If you are familiar with startup investing, some of the rules for impact investing in tech are the same.

We just have a few more.

There are more than three rules, but these three are especially important.

Rule 1: Unicorns look like sturdy camels, not elegant horses

Movies and books describe unicorns as elegant white horses.

In tech, they look like sturdy camels instead.

The first rule of startup investing isn’t betting on great ideas, but choosing teams very (very) hard to kill.

Quoting Zipline’s founder, Keller Rinaudo:

“If you are willing to endure any amount of pain and not give up, it’s really hard for someone else to kill you”.

Early-stage startups should have only one business model: “Survive”

Rule 2: In tech, passion beats love

Do you know that Instagram was originally a location app?

They were expecting users to share messages like “I am at Joe’s restaurant having lunch”.

However, the initial users were way more fascinated by a different kind of message: “This is my lunch - click - photo”.

Instagram changed its business model accordingly.

As a result of this humble-bold move (yes, a pivot can be both), the founder sold Instagram for $1 billion to Facebook.

At the time of its $1 billion exit, Instagram was just a bit more than 2 years old, and it had only 13 employees. That’s an average value of $76.9M for employee. It’s a bit of a silly calculation, still it’s fun.

Zipline didn’t sell to Facebook, but their humble-bold decision to pivot was quite similar.

The issue: Most founders fell in love with their project. It’s their baby, and it shall not change.

The solution: When you invest in tech, avoid these kinds of founders.

Zipline was originally Romotive, a cute app-store robot for kids. A great idea, but it was not working.

They had the courage to throw out of the window three years of work, and start from scratch.

If you are an investor, this boldness is what you should look for.

If you are a founder, this is what should inspire you.

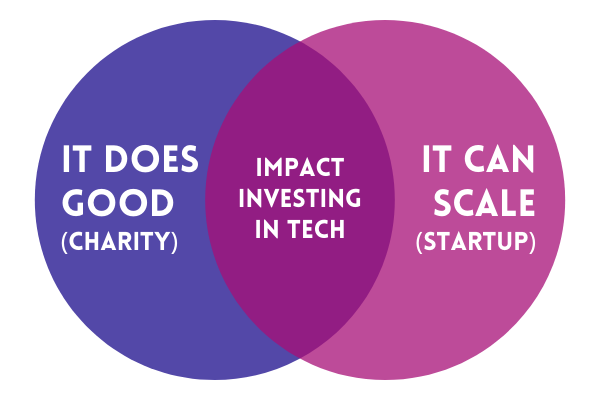

Rule 3: Ask the question “Could they scale the good?”

Charity can do good.

Tech investing can make you money.

Impact investing can make you money and do good at the same time.

… Let’s rephrase it.

Impact investing can make you money and it SHOULD do good at the same time.

If you are an investor looking for an impact startup, or an impact founder looking for investors, you should ask the following question:

– “Can this project scale its good?”

That is the sum of two queries:

Is this project doing real good, or is it just fancy hype?

Can this project scale without losing its impact?

• If the answer to the first question is “Yes”, the project could be a great charity.

• If the answer to the second question is “Yes”, the project could be a great tech startup.

• Only a double positive (Yes + Yes) is an impact investment.

Let’s check Zipline

Question #1 - Is this project doing real good, or is it just fancy hype?

Drones are cool and trendy. But do they really need drone transports for medicinals in Africa?

Answer: Yes (and not just in Africa. In fact - although it was a good choice to start the project in an emerging economy - Europe and North America may benefit from this technology too)

Question #2 - Can this project scale without losing its impact?

Answer: Yes

The more drone they build, the more their costs go down and the network effect goes up ➔ This is a scalable business.

That’s it! Really.

Three simple (but not easy) rules for successful impact investing.

And thanks to Zipline for the inspiration. Keller Rinaudo and team, you are great!

Let’s go out and start using these rules. Let’s build together an Impact Nation every day.

It should not be necessary to add any disclaimer but … Let’s say it anyway! This is not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. DYOR - Do Your Own Research!

Good Gossip

Congrats to …

Elisabeth Brinton ↪ has been appointed to lead the New Sustainability Industry Team at Microsoft.

Georgia Stewart ↪ CEO of Tumelo – an ESG startup – has been appointed member of the independent governance committee at Aviva.

Joerg Walden ↪ has been confirmed co-chair of the Social Impact & Sustainability Working Group of the International Association of Trusted Blockchain Applications (INATBA).

Christoph Scaife ↪ has been appointed Head of Sustainability at Atrato, the alternative investment management group.

John Graves ↪ is the new Chief Investment Officer at The Low Carbon Renewables Fund.

Nicole Musicco ↪ has been appointed Chief Investment Officer at CaIPERS (California Public Employees' Retirement System).

GridPoint ↪ – an intelligent energy network provider – raised $75M in funding. Lead investor Goldman Sachs Asset Management’s Sustainable Investing Group, with participation by Shell Ventures.

SoLa Impact ↪ – a black impact fund – reaches $250M in assets under management. Among the latest investment a $50M by CalSTRS (California State Teachers’ Retirement System).

News & Opportunities

Chile issues the first-ever sovereign sustainability linked bond ↪ They are now available $2 billion, 20-year sustainability-linked bond. The interest paid is tied to the country’s performance on its climate goals.

IBM launches an incubator to facilitate exploration and use of AI for social impact organizations ↪ The IBM Data Science and AI Elite (DSE) Team has already handpicked the first four organizations.

Verizon issues $1 billion green bonds ↪ This is Verizon's fourth green bond offering of $1 billion. The company has announced that its third green bond has been fully allocated.

The U.S. SEC may issue rules for labelling ESG investing products ↪ The U.S. Securities and Exchange Commission’s (SEC) Chair Gary Gensler said that the commission is looking into rules for ESG investment products, including labelling.

🎙 PEOPLE IN IMPACT

Meet: Olivia Sibony

“I believe in using business as a force for good.” – Olivia Sibony

Olivia ‘Liv’ Sibony is an award-winning entrepreneur who left a successful career at Goldman Sachs to launch her food-tech startup, GrubClub (exit to Eatwith.)

She’s been awarded "Top 10 UK Women Entrepreneurs" and “Wise100 Top Women in Social Business”, serves as a board member of UCL’s Fast Forward 2030, which aims to inspire the next generation of entrepreneurs for UN’s Sustainable Development Goals (SDGs), and as a Deputy Chair Mayor of London's Women in CleanTech.

Today, Liv is the co-founder and CEO of SeedTribe, a spinoff platform of the Angel Investment Network focused specifically on connecting impactful businesses with investors and stakeholders who want to play an active part in helping shape the businesses of the future.

Olivia will be a speaker at Expanse, the Global Summit for Impact Investing in Tech. Join him today!

🚀 COMING SOON

Behind the Scenes of Impact Investing (Silicon Valley and Beyond) - With Adeo Ressi, CEO VC-Lab & Chairman Founder Institute

Video interview available from Thursday - Stay tuned!

🙌 Did a friend forward you this email? Join the Impact Nation for FREE today→

🔥 If you liked this post, why not share it?