Web3 and SDGs

What’s Web3 and why it's important for impact investing

Hello Impact Nation,

Happy Tuesday to 1746 amazing impact investors and leaders who subscribed to this newsletter.

In this series of articles, we are going to see what’s Web3 and why it’s so important for impact investing.

Let’s start this journey inside the Web3 secrets today!

This Week We Are Diving Into:

1. Web3 and SDGs - What’s Web3?

2. Good Gossip

3. News & Opportunities

4. Coming Soon: Interview with Olivia Sibony

Elisa

The Impact Lady

Web3 and SDGs - What’s Web3?

When the web was born just a couple of decades ago, it completely changed our life. It was a revolution in terms of how we communicate with each other, it connected us to the world, and it gives us the ability to touch lives on the other side of the Earth. It opened endless possibilities. In a matter of a few years, we saw the good and the bad, but one thing is for sure. Today, we can’t think of living without it.

Now, Web3 is coming at a fast pace. A new revolution that again calls into question the way we are living. But this time is not about communication and connections, is about finance, is about who is controlling our identity and our assets and much more.

Web3: a definition

Web3 is the third generation of the internet.

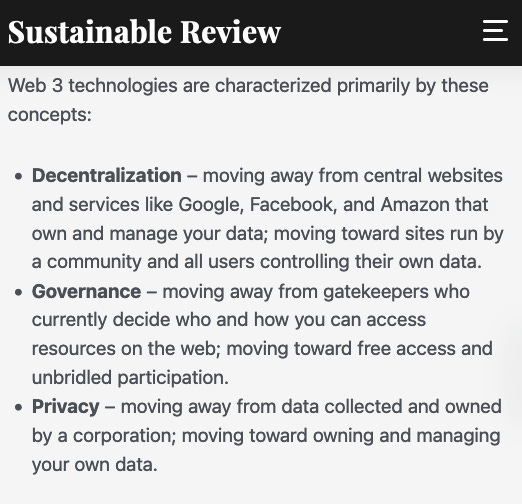

Web3 is not just one thing, it’s a group of technologies that includes blockchain, NFTs, DAOs, cryptographic protocols, social platforms, decentralized finance and digital assets. All of these technologies together aim to create new forms of economic and social interaction by building platforms that allow people to collaborate, create, exchange, and take ownership of their digital identity and assets.

What’s the difference between Web 1.0, Web 2.0 and Web 3.0?

In summary, we can use these references:

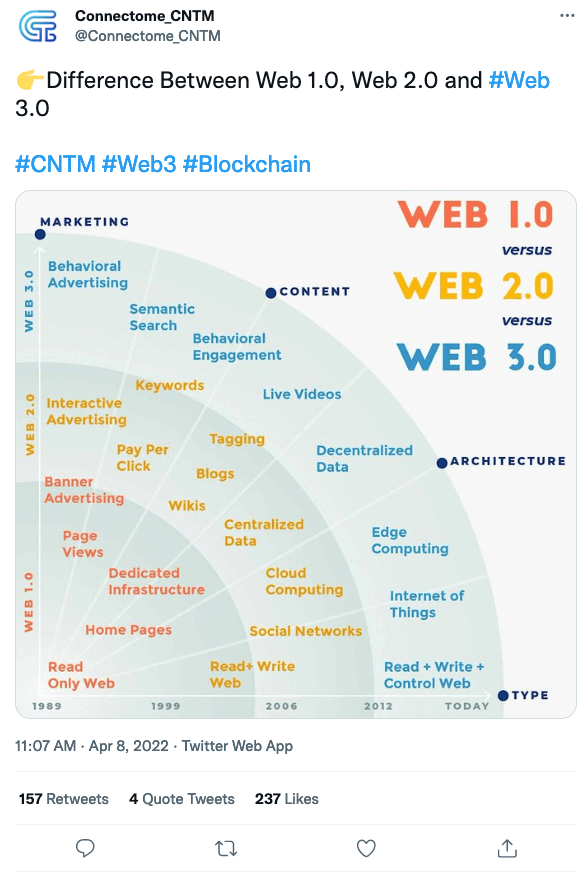

Web 1.0: Read-Only (1990-2004)

Web 2.0: Read-Write (2004-now)

Web 3.0: Read-Write-Own

“Web 2.0 has transformed our economic and social interactions in ways that have profoundly benefited society. At the same time, few would debate that Web 2.0— social media and today’s large tech platforms—took a wrong turn along the way. Neither the public sector nor the private sector has figured out how to grapple with the Pandora’s Box of privacy breaches, disinformation, monopolistic practices, and algorithmic biases that have come to define much of the internet. Meanwhile, authoritarian governments have never had more data with which to surveil, censor, and manipulate their citizens and those of other nations.” A16z (Andreessen Horowitz)

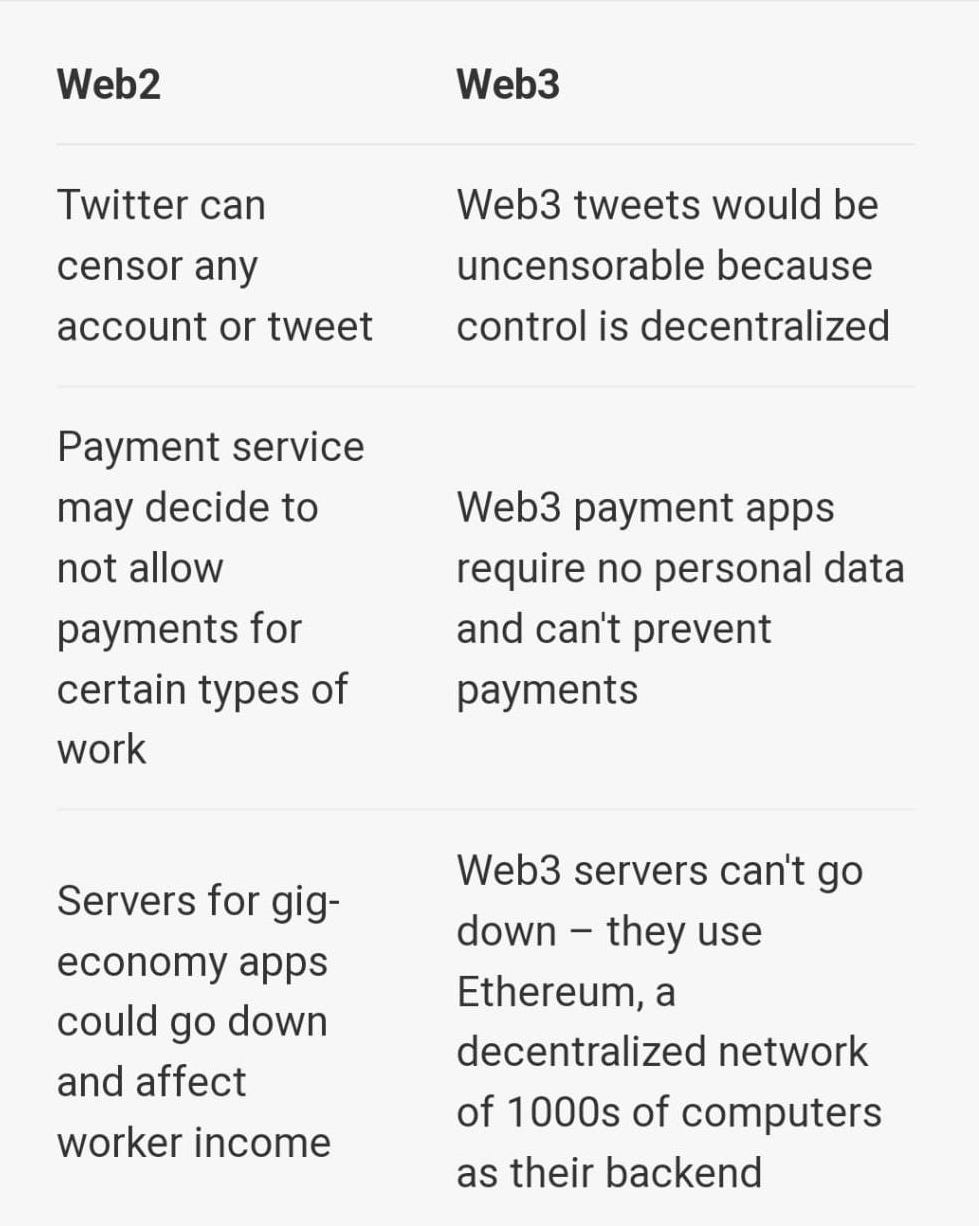

Here are some practical examples of the differences between Web2 and Web3 (“Practical Comparisons Web2 - Web3” - Ethereum.org):

What’s next?

Ideally, thanks to decentralization, which is the basic belief behind Web3, we can decide, as a society, how we want to use these new technologies, and what kind of outcome we want to achieve for our lives and the future of the world.

Of course, it’s up to you to understand all the implications of this revolution and decide if you want to be part of it or not.

One thing is for sure: Web3 is already here and it’s here to stay.

It should not be necessary to add any disclaimer but … Let’s say it anyway! This is not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. DYOR - Do Your Own Research!

Good Gossip

Congrats to …

Kevin O’Donnell, Harriet James, Cathal Carr, Jeffrey Manson, ↪ have been respectively appointed Chair of ClimateWise, VP ESG Strategy, Global Head of Climate and Sustainability Strategy, Head of Global Public Sector Partnerships at RenaissanceRe Holdings Ltd, a global provider of reinsurance and insurance.

Kim Challis ↪ has been appointed Group Director ESG at APCOA Parking Group, a European parking operator.

Alan Somerville ↪ has been appointed Director of ESG at Tritax Group, a real estate investment manager.

Cornelia Gomez ↪ has been appointed Global Head of ESG at General Atlantic, a growth equity firm.

Chris Hayward, Charles Begley, Bola Abisogun OBE, Tim Balcon, Julia Barrett, David Frise, Martin Gettings, Alison Gowman, Emma Hoskyn, Sir Stuart Lipton, Carol Lynch, Iain McIlwee, Fiona Morey, Benjamin O’Connor, Stephen Pomeroy, Hannah Vickers, Danna Walker ↪ have respectively appointed Deputy Chairman of the City Corporation’s Policy and Resources Committee, Deputy Chair and board members at Skills for a Sustainable Skylines Taskforce - City of London Corporation, the task force of governing body of the Square Mile in London to boost skills to decarbonise central London’s commercial buildings.

Better Origin ↪ raised $16M to turn food waste into animal feed. Lead investor: Balderton Capital. Other investors: Fly Ventures and Metavallon VC.

ImaliPay ↪ raised $3M seed fund to offer financial services to underserved gig workers across Africa. Investors: Google Black Founders Fund, Leonnis Investments, Ten 13, Uncovered Fund, MyAsia VC, Jedar Capital, Logos Ventures, Plug N Play Ventures, Untapped Global, Latam Ventures, Cliff Angels, Chandaria Capital, Changecom and Angel investors like Keisuke Honda of KSK Angels and others.

Grover ↪ raised $330M in Series C to rent out your unused electronics and double down on the circular economy. Lead investor: Energy Impact Partners. Other investors: Korelya Capital, LG, Mirae Asset Group, Viola Fintech and Assurant.

Climeworks ↪ raised $650M to scale direct air capture capacity. Lead investor: Partners Group and Singapore sovereign wealth fund GIC. Other investors: Baillie Gifford, Carbon Removal Partners, Global Founders Capital, M&G, and Swiss Re.

London School of Economics ↪ raised $230M for Green & Social Projects from private investors.

ClimateCo ↪ raised $50M to Grow its Decarbonization Solutions Platform. Lead investors: Warburg Pincus and The Heritage Group.

News & Opportunities

Amundi has transitioned $1.2T equity exchange-traded fund (ETFs) into Article 8 ESG fund.

BNP Paribas Asset Management launch an index fund focused on green, social and sustainability bonds, integrating an ESG approach.

American Express Global Business Travel has introduced a carbon-offset purchase program for corporate clients.

Bank of America mobilized and deployed about $250 billion in sustainable finance activity.

European Union retail investment products with an environmental, social and governance (ESG) strategy (including equity, bond and mixed funds) outperformed their non-ESG peers and were also overall cheaper.

🚀 COMING SOON

Finding The Impact Investor’s Mindset - With Olivia Sibony, Founder & CEO od Seedtribe

Video interview available from Thursday - Stay tuned